How to Use Profit and Loss Statements to Grow Your Business in a Strategic Way

Most business owners look at their profit and loss statement only when tax season rolls around or when their accountant asks for it. I understand

Starting a new business is an exciting venture, but it often comes with significant financial needs.

Business loans can provide the essential capital required to get your startup off the ground and running smoothly.

These funds are crucial for covering initial setup costs, such as office space or equipment purchases.

They also help finance vital marketing campaigns to reach your first customers and build brand awareness.

Affiliate Disclaimer: I earn commission (get paid) if you click on the links and purchase a product below. My earnings do not impact the price you pay.

Furthermore, loans can ensure you have sufficient inventory to meet demand and prevent early operational hurdles. Let’s discuss how business loans work and how to secure them!

A business loan is a sum of money borrowed from a financial institution, like a bank or a credit union, or from an alternative lender.

This capital is specifically intended to help a company start, operate, or expand its operations. Unlike personal loans, business loans are tied to the company’s financial health and future.

They come with specific terms, including interest rates, repayment schedules, and sometimes collateral requirements.

The goal is to provide necessary liquidity when a business’s own cash flow isn’t enough to cover expenses or seize growth opportunities.

Startups have diverse financing needs. Various loan types meet these specific requirements. The right one depends on your business model and capital needs.

These are lump sums repaid over a fixed period. They suit large, one-time investments like equipment.

Offering flexibility, you borrow up to a limit and pay interest only on what you use. Ideal for cash flow gaps.

Designed for machinery purchases, the equipment itself often serves as collateral.

Small loans, typically under $50,000, are often from non-profits. They help very small businesses with flexible terms.

Qualifying for a startup loan can be challenging due to limited financial history. Lenders seek stability and potential, so thorough preparation significantly boosts approval chances.

A clear vision and credible plan help minimize their risk. Basic requirements for a startup business loan include:

Requirement | Description | Why it Matters to Lenders |

Solid Business Plan | Outlines business model, market, financials. | Shows business viability. |

Personal Credit Score | Your personal credit history. | Indicates repayment likelihood. |

Collateral (if required) | Assets pledged to secure loans. | Reduces lender risk. |

Industry Experience | Relevant experience in your industry. | Suggests competence, higher success chance. |

Debt-to-Income Ratio | Your personal debt vs. income. | Assesses ability to manage debt. |

To prepare, gather simple documents like your personal ID, proof of income, and a well-structured business proposal.

First, choose the right loan type for your startup’s needs. Research lenders to find the best fit. Next, gather all necessary documents, including your business plan and financials.

Once ready, apply either online or offline. After submitting, wait for approval. Respond quickly to any lender requests.

Step 1: Assess Your Needs: Determine exactly how much money you need and for what purpose.

Step 2: Research Lenders: Explore banks, credit unions, and online lenders specializing in startup loans.

Step 3: Prepare Documentation: Collect all required financial, legal, and business planning documents.

Step 4: Submit Application: Complete the application form accurately and submit it with all supporting documents.

Step 5: Underwriting Process: The lender reviews your application, conducts credit checks, and assesses risk.

Step 6: Loan Decision: Receive approval or denial; if approved, review the loan terms carefully.

Step 7: Fund Disbursement: Once terms are accepted, the loan amount is transferred to your business.

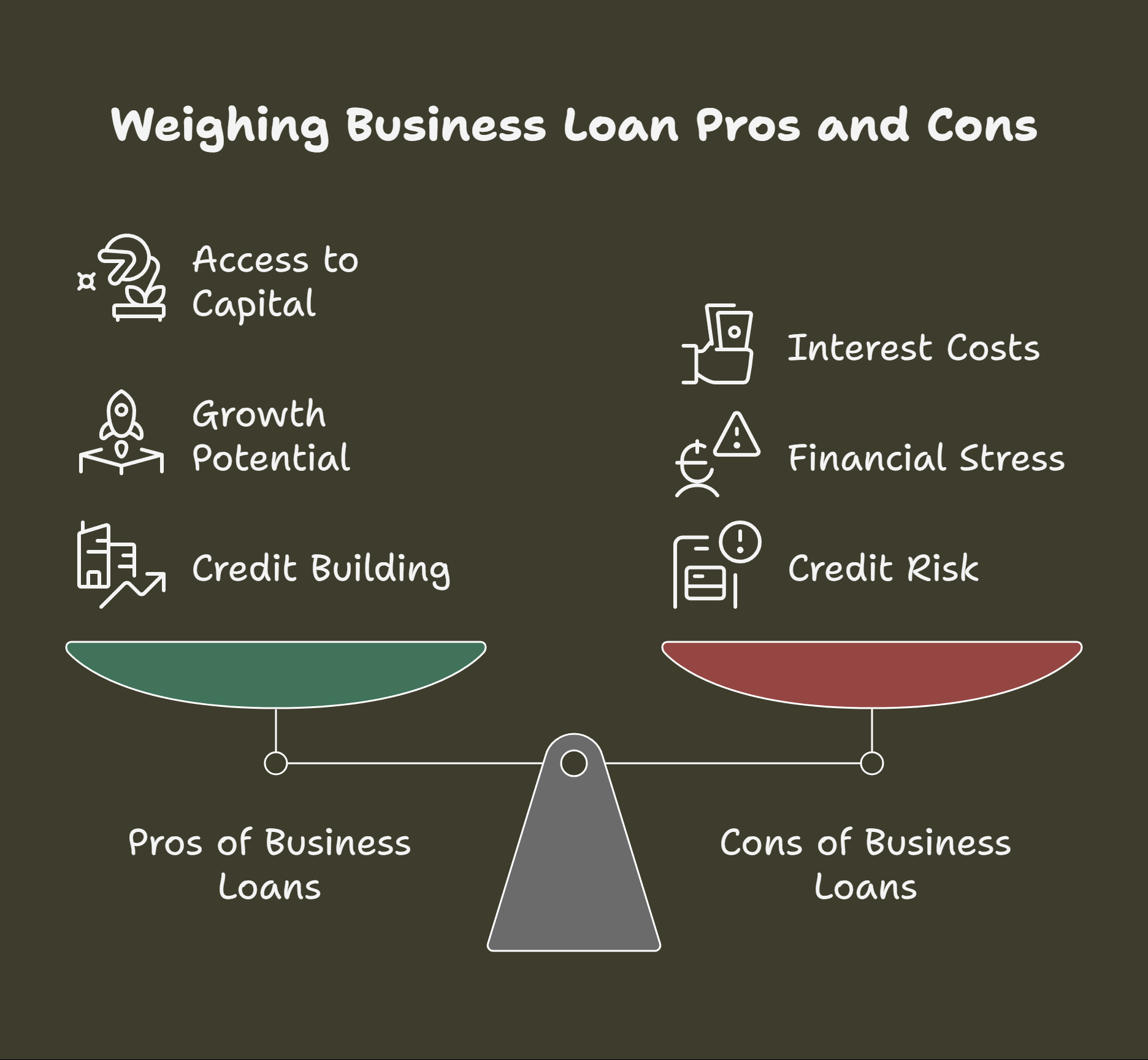

A business loan greatly affects a startup’s journey. Weighing its pros and cons helps you make an informed decision for your business goals.

Pros:

Cons:

Securing a business loan is a significant achievement, but using the funds effectively is even more critical for your startup’s long-term success. A loan is a tool for growth, not a blank check.

Strategic allocation of these funds can make the difference between thriving and struggling. Avoid impulsive spending and focus on investments that will yield a clear return.

Wise Loan Usage | What to Avoid |

Invest in Core Needs | Spending on unnecessary luxuries or excessive overhead. |

Fund Inventory | Using funds for personal expenses or non-business items. |

Launch Targeted Marketing | Investing in unproven or speculative ventures. |

Hire Essential Staff | Taking on debt for expenses that don’t generate revenue. |

Purchase Revenue-Generating Equipment | Paying off existing personal debts without a clear plan. |

Build Working Capital Reserves | Overspending on initial setup without future cash flow in mind. |

Business loans are common, but not the only startup funding option. Alternatives offer flexibility, reduce debt, or provide capital when traditional loans are unavailable.

Taking a business loan is a major commitment. Avoid common pitfalls to protect your startup’s financial health. Careful planning is essential.

Business loans powerfully fuel startup growth and stability. They provide crucial capital for setup costs, marketing, and inventory.

Know loan types, qualifications, and application steps to secure funds. While offering vital access to money and credit building, consider interest and repayment stress.

Use loans wisely, avoiding mistakes. Applied strategically, loans help new ventures thrive by meeting critical operational needs.

Most business owners look at their profit and loss statement only when tax season rolls around or when their accountant asks for it. I understand

If you run a business, people will look you up. They do it before they call. They do it before they buy. They do it

Entrepreneurship is often portrayed as action-driven. Build faster. Launch sooner. Execute relentlessly. While action is essential, action without informed thinking often leads to unnecessary mistakes.

Copyright 2021 Dwayne Graves Online | All Rights Reserved |