Kartra and Leadpages both help you grow your business online fast. But they serve different purposes, so the choice really depends on you. Kartra is

You’re probably tired of paying to live in a space where you hear noise coming through the walls or where there’s no backyard to relax in during the weekend.

While it sounds attractive to have your own home, it’s possible that you’re unsure how to save for a house while paying for rent.

Renting can be a hassle. You have to constantly worry about whether or not you’re going to get your security deposit back, if the landlord will fix things when they break, and if you’re ever allowed to hang any decorations in the home.

The good news is that there are plenty of other housing options besides renting! If it’s time for you to find your own place, here are some tips on how:

-Save money before looking at homes so that once one pops up that looks like a good fit for you, you’ll already have enough cash saved up for.

-Do your research. Find out what type of home would be best for you based on price, safety, schools, and commute times.

However, I want you to know that it’s absolutely possible!

Let’s dig into how to do it.

It’s hard to reach a savings goal when you don’t set a specific dollar amount as the target.

Determine the exact amount you need to save so that you understand how much to set aside each month and how long it should reasonably take to reach the goal.

Make your first goal to save 20% of the estimated home purchase amount. For example, you should save $50,000 if you think your home will cost $250,000.

This is a solid goal because you can avoid paying for what’s called private mortgage insurance (PMI) if you have a 20% down payment.

PMI is an extra monthly fee that the mortgage company makes you pay in order to protect them in the event that you can’t make your payments. Isn’t it interesting how you pay an insurance premium to protect them? That’s a story for another day…

If 20% sounds impossible right now, then set your sights on a 5% or 10% down payment at first. Set a goal that sounds reasonable so that you aren’t defeated before getting started.

You might discover that saving a 5% down payment spurs you on to go after the 10% and 20% goals.

By the way, consider that most experts recommend getting a monthly mortgage payment that doesn’t go above 25% of your monthly net pay (the amount you take home after taxes).

Use that figure when estimating how big of a home you can afford and then plan the needed down payment from it.

Determine How Long It Will Take To Save Your Down Payment

It’s up to you in terms of how long you want to wait before buying your new home.

I would recommend working hard to save your down payment within the next couple of years. This way, you can get into your home and then focus on other long-term goals, such as college for your children and your retirement.

Knowing how much you need to save and the timeframe to do it tells you how much to save monthly.

For example, you’ll need to save about $2,000 per month for 24 months if you need a $50,000 down payment.

Sound impossible based on your current income and expenses?

If it does, then that signals a need to make some dramatic changes in your life. I say that because you can expect to pay at least $2,000 per month after buying a house to cover your loan’s principal & interest, insurance, taxes and set aside money for future house repairs.

Here are some ideas to help you find money to save for your down payment:

Anything is possible if you take it seriously and make decisions that help you accomplish the goal.

Decide Where To Put Your Down Payment Savings

Avoid the temptation to keep the money you’re saving for a house down payment in your checking account.

It’s typically better to create a separate account so that you can’t easily spend the money on other things.

You might want to consider a simple money market account because you’ll make a little bit of interest and won’t get charged fees when it’s time to take the money out.

I gave you some ideas above for finding the money to save.

Let’s go into this topic more specifically because you might be amazed when considering how much money you already have available for a down payment savings account.

Do you spend money on any of the following every month?

A typical family might spend more than $500 per month on these types of items.

Can you get creative and make a few sacrifices in these areas for the next 24 months if it means buying your new home?

$500 x 24 months = $12,000!

Are you already saving money toward retirement or college for your children?

If so, you might want to consider putting those monthly payments into your future home’s down payment fund for now.

This may sound strange but it’s a great way to find a few hundred dollars each month that could add up to $10,000 or $20,000 over the next couple of years for the needed down payment.

Combining this strategy with the tips from the previous section might be all that’s needed to save your down payment over the next 18-24 months.

Of course, make sure that you get right back to putting that money into college and retirement the moment you’re living in your new house.

I quickly mentioned finding a side hustle above and I’d like to explore that a bit more with you.

You might stop spending money on clothes or cable and add your retirement savings into the mix and still come up short of the goal.

If that’s the case, then you need to make more money until your down payment goal is accomplished.

Why not find a part-time job or some sort of side gig? This doesn’t need to be something you hate doing. Here are some examples of side hustles:

As you can see, it’s not as hard to save for a house down payment as you might have previously thought.

It simply takes the “want-to” and some rearranging of your budget or a willingness to work a little harder over the next 24 months.

It’s all worth it in the end if you can get a more advantageous loan than you would when going into the home-buying process without a down payment.

Kartra and Leadpages both help you grow your business online fast. But they serve different purposes, so the choice really depends on you. Kartra is

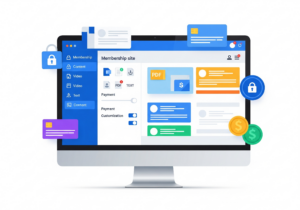

A membership site gives content only to people who sign up first. It’s great for courses, training, digital products, or private communities. You control who

Kartra is an all-in-one platform made for online businesses. It helps you build, launch, and grow your business from one place. You don’t need ten

Copyright 2021 Dwayne Graves Online | All Rights Reserved |