Kartra vs. Leadpages: Which is Better for Your Lead Generation?

Kartra and Leadpages both help you grow your business online fast. But they serve different purposes, so the choice really depends on you.Kartra is an

Are you trying to launch a new business? Do you have big startup company ideas, but lack the funding to make it a reality? Are you looking for small business startup loans?

You’re not alone.

Entrepreneurs and small business owners are finding it increasingly harder to acquire the best business funding. These kinds of starter loans can be quite difficult to come by, but there are some more unconventional methods you might want to try instead to get the financing you desire.

Most start-up companies can’t get the funding they need from banks, and many believe that without bank funding, their business will never break ground.

But, that just isn’t the case anymore.

Never give up on your business dreams.

Small business loans are available; you just have to know where to look to find the best options and apply. Many business owners still consider bank funding to be the best form of capital – but unconventional methods of starter funding are becoming increasingly popular too.

Whatever type of business you’re interested in, with small business start-up loans, you can get the funding you need to help with:

To start and grow your business, you must be open to some unconventional business loans and alternative business funding options. But getting a small business loan for your new business is possible.

Franchises are popular options for many startups. This is because they can follow an existing business model that has already been proven successful, improving the chances of success. This option is also often viewed as less risky for lenders.

Depending on the franchise you chose, you can expect anywhere from $4,000 to $200,000 in start-up costs.

Whether you’re looking to open your first franchise or expand to new locations, small business startup loans can help you to get your franchise up and running. And, because of the lower element of risk involved, getting hold of franchise start-up loans is much easier than you might think.

When you’re ready to fund your business, remember, you have more options available besides just the traditional bank loans to apply for and access capital.

In most cases, banks won’t be comfortable lending to startups. But, that doesn’t mean your dreams have to come to an end. Look, instead, for other methods of funding for your starter business.

You can still research and get the best loans that suit your needs. Options such as:

You just want to make sure that you have a solid strategy in place for how you will use these funds to help grow your business.

Then, you could be receiving up to $250,000 to help start and grow your business through our recommended company who can offer:

Just click below to set up a free consultation to determine what business funding solutions are best for your business. There is no obligation, so you can see how to get the best small business loans for a startup company without worry. Click here for a free consultation

Save

Kartra and Leadpages both help you grow your business online fast. But they serve different purposes, so the choice really depends on you.Kartra is an

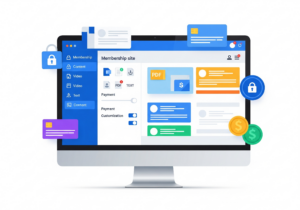

A membership site gives content only to people who sign up first. It’s great for courses, training, digital products, or private communities. You control who

Kartra is an all-in-one platform made for online businesses. It helps you build, launch, and grow your business from one place. You don’t need ten

Copyright 2021 Dwayne Graves Online | All Rights Reserved |