Starting an online business feels exciting at first, but the money side can get confusing fast. Many beginners jump in with enthusiasm but feel lost when it comes to managing their finances. They want freedom, but their spending often says otherwise.

When you’re new, it’s easy to overspend without noticing. You buy tools because others recommend them. You subscribe to software you barely use. You invest in every shiny thing because it feels like progress. But soon, the numbers stop adding up, and the stress creeps in.

Download Your Free e-Book

5 Simple Ways to Create Website & Landing Pages

Affiliate Disclaimer: I earn commission (get paid) if you click on the links and purchase a product below. My earnings do not impact the price you pay.

I made the same mistake. When I started, I spent money on everything and had nothing left for marketing. I bought tools I didn’t need. I upgraded things that didn’t matter. I invested everywhere except where it produced results. It slowed my growth more than anything else.

That’s why financial clarity, smart spending, and avoiding mistakes matter more than most new entrepreneurs realize. Budgeting isn’t about limiting yourself. It’s about giving your business the oxygen it needs to grow.

In this guide, we’ll break budgeting down into simple, practical steps. No complicated jargon. No confusing spreadsheets. Just a clear roadmap that shows you exactly how to manage your money from day one.

By the end, you’ll know how to avoid waste, use your money wisely, and build your business with confidence.

Start With a Clear Picture of Your Income and Expenses

When you start an online business, the first step is understanding your financial landscape. You must know exactly how much money you have, how much you expect to make, and where that money needs to go. Without clarity, everything else becomes guesswork.

Think of your business like a car. You wouldn’t drive long distances without checking your fuel. Your money is that fuel. Understanding your income and expenses keeps everything running smoothly.

The easiest way to start is by creating a simple spreadsheet or using budgeting apps. It doesn’t matter what tool you use; what matters is consistency. Write down every amount of money coming in and every dollar leaving your pocket.

Use a list of common expenses, like:

- Software and tools

- Subscriptions

- Marketing

- Education

- Website-related costs

- Equipment

Examples: track subscription costs, software tools, and marketing spend. Even small expenses add up quickly.

Highlighting total cash available, knowing every expense, and avoiding surprises will give you control from day one.

Let’s look at a quick story:

Sarah, a beginner freelancer, kept wondering why her business wasn’t profitable. She assumed she wasn’t earning enough, but when she actually listed her expenses, she found she was paying for seven tools she didn’t even use. She canceled four, downgraded two, and suddenly had $150 extra per month for marketing.

A simple list saved her business from a slow financial bleed. When you see everything clearly, you make smarter choices, protect your cash, and stay in control.

Identify Fixed vs Variable Costs in Your Business

Once you understand your overall expenses, it’s time to separate them into fixed costs and variable costs. This helps you understand what you must pay monthly and what you can adjust depending on your situation.

Fixed costs stay the same every month. They’re predictable and easy to plan for. These include things like:

- Domain fees

- Website hosting

- Email marketing subscriptions

- Essential software

Example: website hosting is fixed.

Variable costs, on the other hand, change monthly depending on your strategy and business performance. These include:

- Paid ads

- Freelance support

- Extra tools

- One-time purchases

Example: ad campaigns are variable.

Understanding the difference allows you to build a financial foundation with predictable spending, flexibility, and control over cash flow.

Here’s a story:

Jake was running his e-commerce store and noticed a slow month approaching. Instead of panicking, he reduced his variable costs, mainly ads and contractors, while keeping his fixed costs steady. He stayed profitable without stress because he understood what could move and what couldn’t.

Knowing the difference between these two categories makes budgeting simple. Fixed costs keep your business running. Variable costs help your business grow. Managing both thoughtfully gives you long-term stability.

Prioritize Spending on Revenue-Generating Activities

Every dollar in your business should ideally help bring in more revenue or reach more people. This is the foundation of smart budgeting.

When money is tight, you must ask: “Does this expense help my business grow?” Begin by focusing on activities that directly impact sales or audience growth.

Examples: invest in ads, quality content, or tools that improve efficiency.

When you invest in the right areas, your growth accelerates. When you waste money on non-essentials, you stall. This is where spending smart, ROI-focused, and growing faster become essential principles.

Here’s a story:

Maria started selling digital products but spent over $300 on templates, premium themes, and “advanced AI tools.” None of them increased sales. Eventually, she cut everything unnecessary and put that money into ads. In 30 days, her revenue doubled. That shift transformed her business.

The takeaway? Prioritize spending that fuels growth. Ignore the shiny distractions. Focus your money where it produces a return. That’s how smart entrepreneurs budget.

Set a Monthly Budget and Track It Religiously

Once you know your expenses and have established your priorities, it’s time to create a monthly budget. This is your roadmap, and it only works if you stick to it with discipline.

Start with realistic income projections. Don’t assume you’ll make more than you actually do. Budget based on what you know, not what you hope.

Break down your expenses into categories and assign percentages. Examples: allocate 30% to marketing, 20% to tools, 10% to education.

Then track everything. Daily or weekly tracking prevents surprises. Whether you use a spreadsheet, an app, or a notebook, you must update it consistently.

Your goal is simple: track everything, stick to limits, and review weekly.

Here’s a helpful story:

Liam, a beginner YouTuber, realized mid-month he was overspending on video tools. Because he tracked weekly, he caught the issue early. He adjusted the rest of his month and saved his cash flow. Tracking saved him from a downward spiral.

The truth is simple: A budget only works if you follow it. Stay consistent, stay organized, and stay aware. That’s how you master your business finances.

Plan for Unexpected Costs to Avoid Financial Stress

Unexpected expenses always show up in business. They don’t ask permission. They don’t check your budget. They appear when you least expect them. And if you’re not prepared, they can cause panic.

This is why you need a small emergency fund. Not a huge savings account — just a buffer that protects your business when things go wrong.

Examples: software renewal, equipment repair, sudden ad cost increases.

A financial buffer gives you a financial cushion, stress-free growth, and keeps you prepared for surprises.

Here’s a short story:

Emily ran her online coaching business smoothly until her main tool unexpectedly doubled its price. Most beginners would panic, but she had a small reserve fund. She paid the updated fee without stress and had time to find an alternative tool. That buffer saved her business.

The lesson is clear: Unexpected costs are guaranteed. Stress is optional. Prepare early and stay calm later.

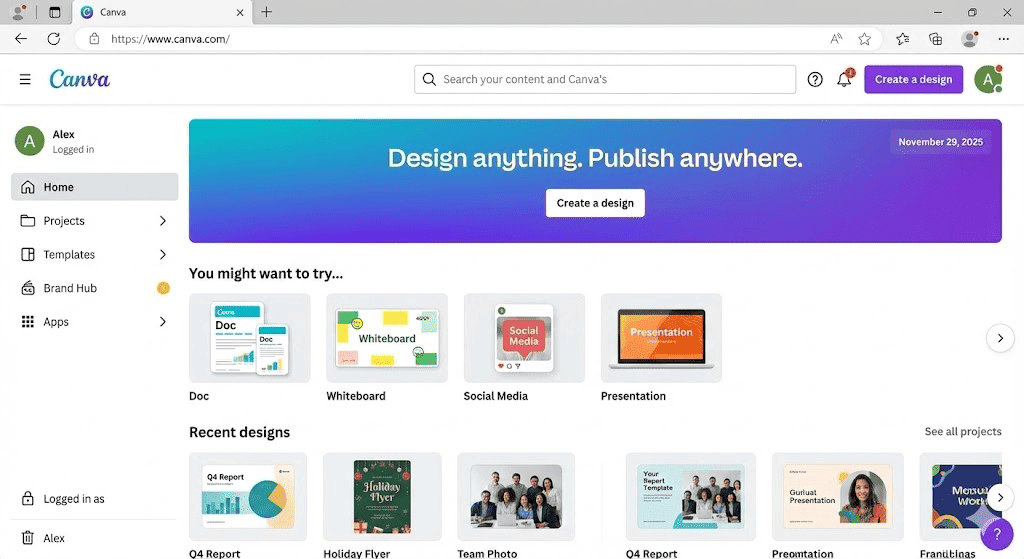

Use Free or Low-Cost Tools Wisely

One of the biggest mistakes beginners make is believing they need expensive tools to appear “professional.” You don’t. The best businesses start simple.

There are incredible free or low-cost options available:

- Free website builders

- Canva

- Free email marketing tools

- Basic hosting plans

- Free project management apps

You can build momentum without draining your bank account. Use tools that are cost-effective, maximize value, and allow you to start small.

Here’s a story:

Jason launched his blog using only free tools for three months. He used Canva for graphics, a free email tool for subscribers, and a basic website builder. He grew an audience, made his first income, and only upgraded once he had proof his business worked.

The takeaway? Start small. Scale thoughtfully. Don’t waste money on tools you don’t need yet.

Conclusion

Now that you’ve learned how to budget your money wisely, let’s bring it all together. You need to understand your income and expenses. Know the difference between fixed and variable costs.

Prioritize spending on growth. Track your budget monthly. Prepare for emergencies. And use cost-effective tools.

Budgeting seems intimidating at first, but once you break it down, it’s simple and manageable. This is your chance to build a financially strong business from day one.

Remember to start small, stay disciplined, and grow confidently. Take control of your business finances today. Your future self will thank you.