Kartra vs. Leadpages: Which is Better for Your Lead Generation?

Kartra and Leadpages both help you grow your business online fast. But they serve different purposes, so the choice really depends on you. Kartra is

A good credit score helps you get approved for business loans fast. Lenders check your credit before giving you money for your business.

If your score is low, they may reject or charge higher rates. A high score shows you repay debts and manage money responsibly.

It builds trust and increases your loan approval chances with lenders. It can also help you get lower interest and better terms.

Affiliate Disclaimer: I earn commission (get paid) if you click on the links and purchase a product below. My earnings do not impact the price you pay.

Even if you’re just starting, credit score still matters a lot. You need to know your score before applying for any loan.

Through this guide, we’ll help you check, fix, and improve your score. Follow the steps and make your business ready for future funding.

Let’s break it down so you can build credit with confidence!

Your credit score tells lenders how risky you are to trust. Most lenders want to see at least a 650 score. A score of 650+ is considered good for many lenders.

680+ is better and may help get lower interest rates. 700+ is great and often leads to faster loan approvals. Keep in mind, every lender follows different credit requirements.

Some may approve lower scores with strong business income proof. Others prefer high scores to reduce their lending risk. A high credit score gives you more funding options overall.

You can also negotiate better terms when your score is strong. It’s smart to check your score before applying for business credit. If it’s low, improve it before submitting any loan application.

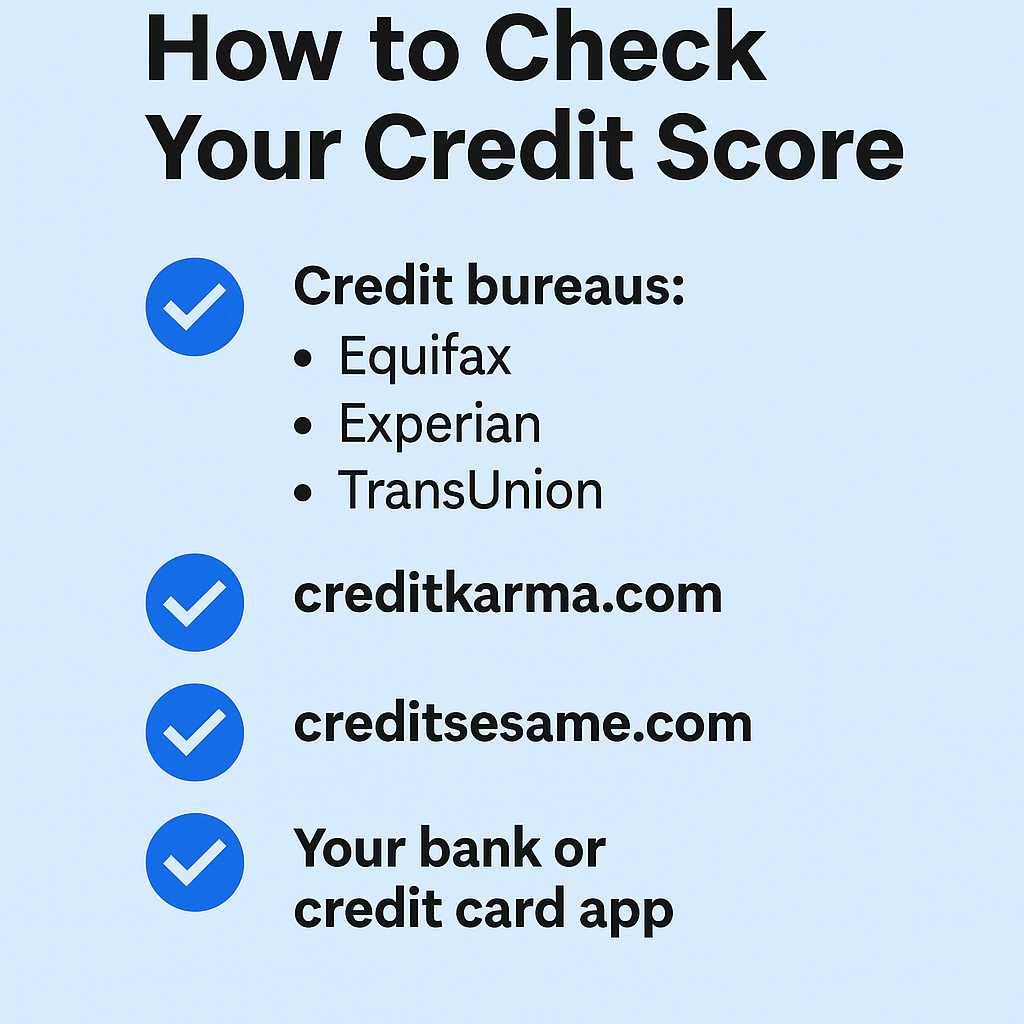

To check your credit score, you have many simple options available. Start with the major credit bureaus: Equifax, Experian, and TransUnion.

They often allow one free credit report every twelve months per bureau. Visit their official websites and request your report in a few minutes.

Credit Karma and Credit Sesame also offer free and fast score checks. These sites update weekly and explain your score in simple terms.

Most banks and credit card apps also show your credit score. Log in to your banking dashboard and check for score options.

What to look for:

Review everything carefully and make sure it’s accurate and up-to-date. If something looks wrong, you can dispute it directly through the site.

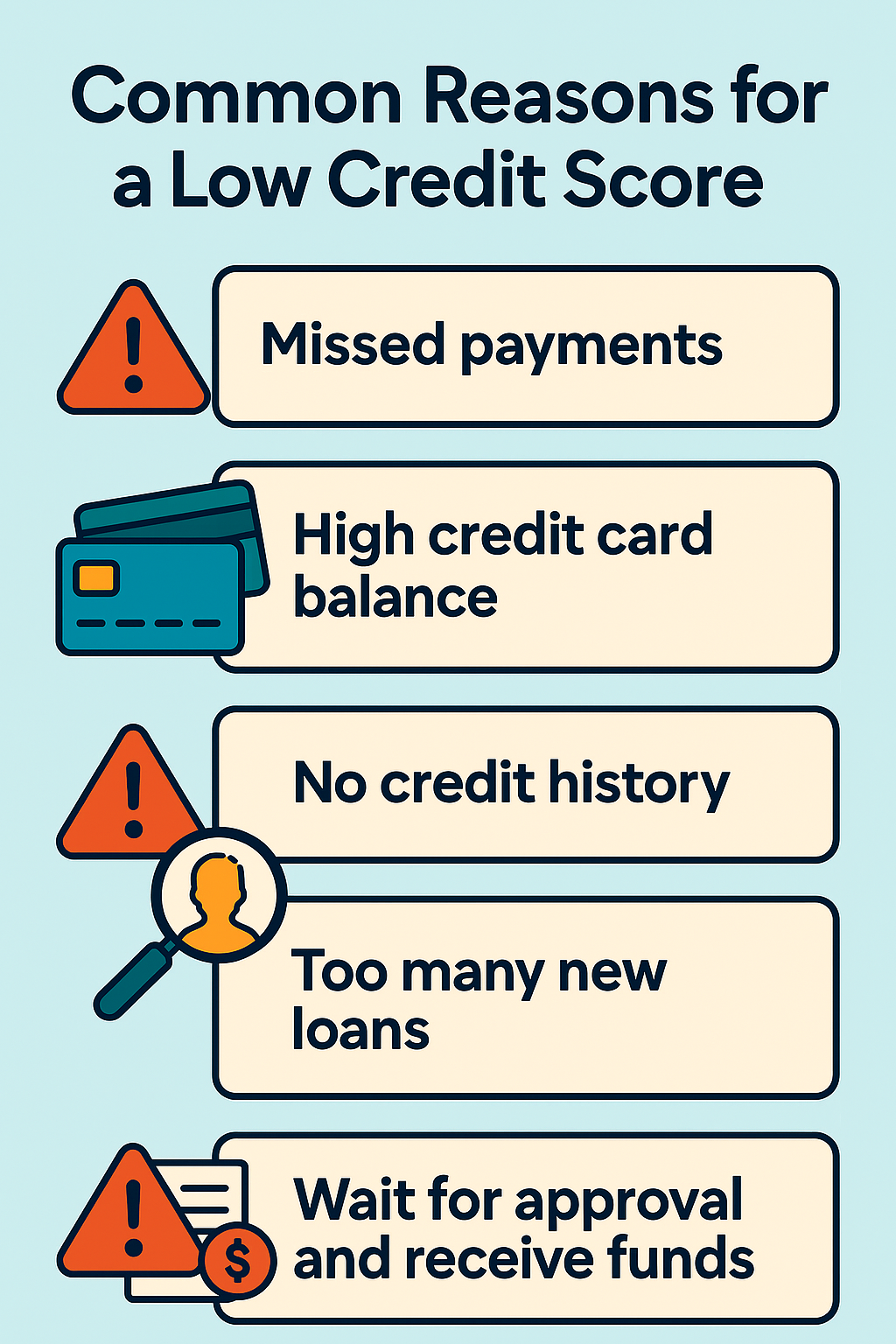

Here are the most common reasons why your credit score drops:

Paying bills late can hurt your credit fast. Lenders want to see that you pay on time. Just one missed payment can lower your score a lot.

Maxing out cards is a red flag for lenders. Try to keep balances below 30% of the limit. Using too much credit shows poor money habits.

If you’ve never used credit, you have no record. Lenders can’t trust what they can’t see. Start small with a secured card or simple loan.

Opening many loans quickly looks risky to lenders. Each credit check can lower your score slightly. Space out loan applications to avoid a score drop.

Watch these areas to keep your credit healthy. A good score opens doors to better business funding.

Fixing a bad credit score takes time but is completely possible. Here are some things that you can do to fix your bad credit:

Late payments lower your score fast. Set reminders or use auto-pay to stay on track.

Pay down your credit card balances. Keep your credit utilization below 30% if possible.

Every loan application creates a hard credit check. Too many checks make lenders see you as risky.

Check your report for mistakes or wrong entries. Dispute incorrect info with the credit bureaus directly.

Good habits take time but lead to great results. The more stable you are, the higher your score grows.

Your credit score matters when applying for business loans. A higher score helps you get better rates and quick approval. Start by checking your score from trusted credit report sources.

Fix errors, pay on time, and lower your credit card balance. Avoid applying for too many loans at the same time. Stay patient and build your score with smart financial habits.

Good credit opens more doors for your business to grow. Take control today and work towards a stronger financial future.

Kartra and Leadpages both help you grow your business online fast. But they serve different purposes, so the choice really depends on you. Kartra is

A membership site gives content only to people who sign up first. It’s great for courses, training, digital products, or private communities. You control who

Kartra is an all-in-one platform made for online businesses. It helps you build, launch, and grow your business from one place. You don’t need ten

Copyright 2021 Dwayne Graves Online | All Rights Reserved |