The Importance of Building a Strong Online Presence From Day One

If you run a business, people will look you up. They do it before they call. They do it before they buy. They do it

Growing an online business takes more than passion and a good idea. You also need capital, especially if you’re aiming to scale fast, build a strong brand, or enter new markets.

Securing up to $250,000 in funding can help you unlock new levels of growth. Whether you need it for product development, marketing, or hiring a team, we’ll show you how to get there.

Stay tuned as we break down your funding options and the steps to make it happen.

Affiliate Disclaimer: I earn commission (get paid) if you click on the links and purchase a product below. My earnings do not impact the price you pay.

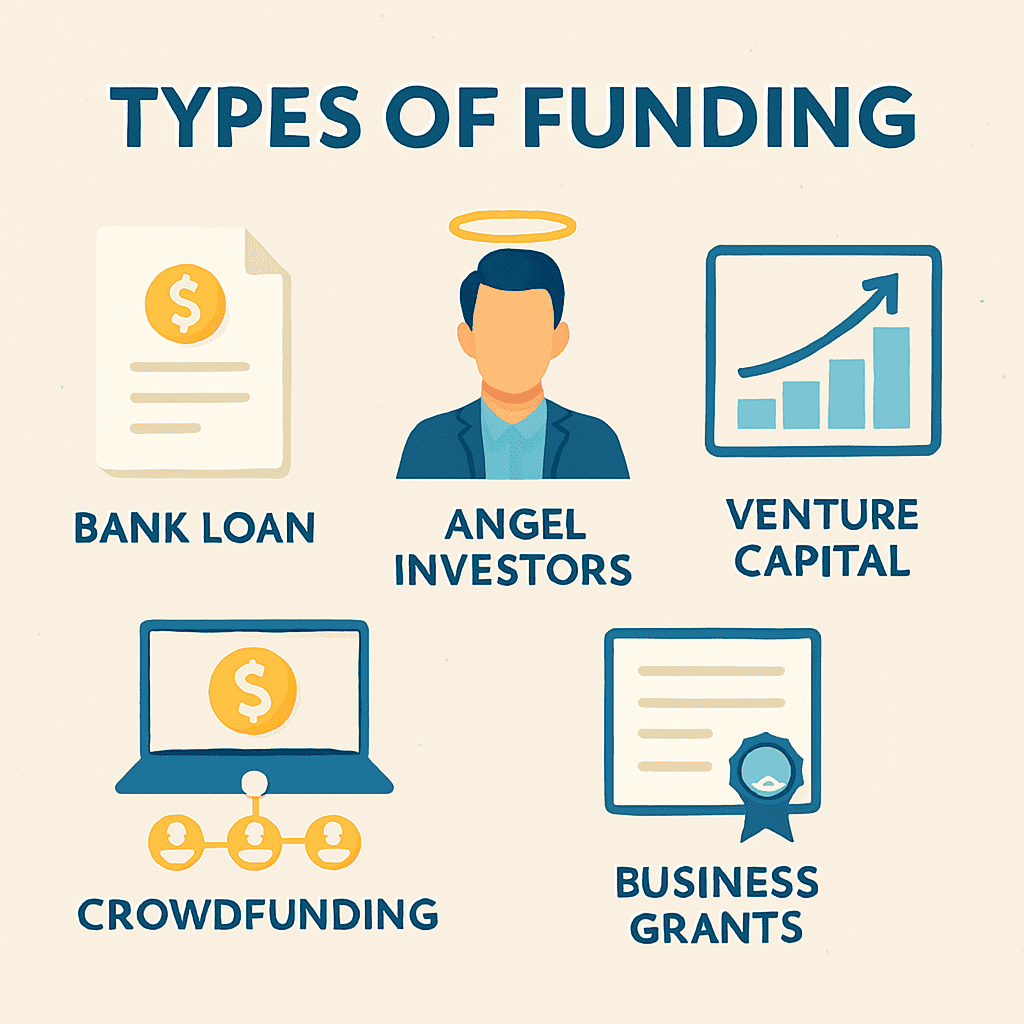

There’s no one-size-fits-all when it comes to funding. Each method serves a different business stage or style. Here’s a quick overview:

Bank Loans:

Angel Investors:

Venture Capital (VC):

Crowdfunding:

Business Grants:

Before asking for money, you need a solid plan. Investors, lenders, and grant committees all want to see where their money will go.

Section | What to Cover |

Executive Summary | Your business idea and why it matters |

Revenue Model | How do you plan to make money |

Target Market | Who you’re serving and how you’ll reach them |

Growth Strategy | Where you’ll be in 1-3 years and how you’ll scale |

Financial Projections | Forecasts, expenses, and profit potential |

Tip: Keep it short, clear, and backed with data. Use visuals or charts to explain numbers. A clean plan increases your credibility fast.

Reaching out to investors may feel intimidating, but it doesn’t have to be. Most investors want to see confidence, clarity, and numbers that make sense.

Here are some key steps that will help you become investor-ready:

Research the Right Investors

Look for angel networks or VC firms that fund online businesses.

Craft a Powerful Pitch Deck

Include your product, market size, traction, and funding needs.

Show Real Numbers

Even small wins like user growth or monthly revenue help a lot.

Highlight Growth Potential

Investors want returns. Show how their $250K leads to big outcomes.

Bonus Tip:

Start building investor relationships early. Comment on their LinkedIn posts, attend pitch events, or join startup communities. Warm intros always work better than cold pitches.

Traditional bank funding is still a solid choice. It works great, particularly for established businesses.

Option | Description |

Term Loan | Fixed amount, fixed interest, fixed schedule |

Line of Credit | Flexible borrowing limit; pay interest only on what you use |

Note: If you’re just starting out, some banks offer SBA-backed loans for easier approval.

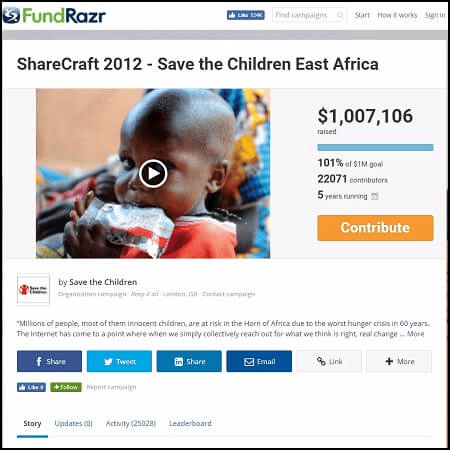

Crowdfunding lets you raise funds directly from the public. It’s fast, social, and can also test your product’s popularity.

If you’re looking to launch a crowdfunding campaign, you can check out these tips:

Create a Compelling Video

Show your product, your story, and what makes it unique.

Offer Smart Rewards

Early access, discounts, or exclusive products work well.

Set a Realistic Goal

Ask for what you need, but back it with a clear plan.

Crowdfunding builds buzz and brings loyal fans early on. Just make sure to fulfill promises once the campaign ends.

Grants are often overlooked, but they’re essentially free money. They don’t require equity or repayment, but they do require effort.

Source | Description |

Grants.gov | U.S. government grants for businesses |

SBA (Small Business Admin) | Offers resources and funding programs |

Local Chambers or Nonprofits | May offer city or industry-specific funds |

Private Corporations | Many run grant contests (e.g., FedEx Grant) |

Important: Even if you don’t win the first time, applying improves your skills and builds visibility.

Do you know, securing funding is only half the battle? The key difference maker stage is to know how to use it wisely.

Use funding to build momentum for your online business. Keep tracking ROI and stay lean where possible.

Securing $250,000 in funding is achievable with the right approach. Regardless if you go through investors, banks, crowdfunding, or grants, each path has unique benefits.

But the key lies in preparation. Build a strong plan, track your metrics, and approach funding with clarity and confidence.

Once the money is in hand, use it strategically to grow what matters most: your customers, team, and impact. With smart planning and focus, you’ll turn funding into sustainable growth.

If you run a business, people will look you up. They do it before they call. They do it before they buy. They do it

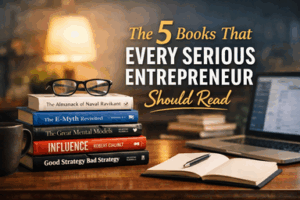

Entrepreneurship is often portrayed as action-driven. Build faster. Launch sooner. Execute relentlessly. While action is essential, action without informed thinking often leads to unnecessary mistakes.

Marketing is often one of the most intimidating parts of starting an online business. New founders are quickly exposed to complex strategies, unfamiliar terminology, and

Copyright 2021 Dwayne Graves Online | All Rights Reserved |