Kartra vs. Leadpages: Which is Better for Your Lead Generation?

Kartra and Leadpages both help you grow your business online fast. But they serve different purposes, so the choice really depends on you.Kartra is an

When it comes to credit cards, guess what? They are not all created equal. When you are ready to apply for a credit card, you want to make sure you do your research.

Then sign up for the best match for you.

The Delta credit card offers many rewards, but that doesn’t mean it is the right card for you.

You can find out if you are approved in a few short minutes. No waiting…no hassle.

If you are wondering why should you get a Delta SkyMiles credit card, you will learn more about all that it offers.

But you still must determine if those rewards are the ones that you actually need.

Is the Delta SkyMiles credit card worth it?

Because your time is valuable, you don’t want to wait a long time to be able to use your new credit card. For this reason, many people prefer feature-rich, instant approval credit cards like the Delta SkyMiles credit card that allow you to earn rewards and benefits like cashback and airline miles.

Now that we answered that question, here is what we will discuss…

Typically when you apply for a credit card, it may take some time. You can expect the credit card company to take five to ten business days to process your application. Assuming approval, there is usually a waiting period of several more days before you get your card in the mail.

The entire process can be lengthy and time-consuming, and under most circumstances, that’s not a big problem. But if you need credit now.

Whether for an emergency, an upcoming trip, or simply because you found a deal that’s too good to pass up – an instant approval credit card simplifies the application process.

Instead of waiting days or weeks for a verdict on your creditworthiness, you can expect to find out within minutes.

When you apply for an instant approval credit card, the credit card company will run a preliminary credit check. The higher your credit score, the more likely that your application will be approved.

Assuming your score meets their requirements, the credit card company will likely issue “conditional approval”. It is temporary while they perform a more thorough examination of your credit history.

Your age, place of residency, income, and prior credit history are all used to determine your creditworthiness. If your financial history is riddled with debt, or if you have no credit history, it’s probable that you will not make it through the conditional approval stage.

Once your financial history has been vetted and your creditworthiness established, you can expect to receive your new credit card. It may take five to seven business days for it to arrive via mail. At this point you can activate your card and start developing your credit history.

If you are trying to rehabilitate your credit score after past poor financial decisions, you can explore other options. If you’re a young person with no credit history trying to obtain your first credit card, there are options available.

These options include instant approval student and secured cards. These cards come with some additional restrictions including lower credit limits, higher interest rates, and obligatory deposits. The deposits must be made up front before your card can be issued.

While instant approval means you can expect to have a credit card in your hands sooner. It is no guarantee that you’ll be approved, nor does it mean a card will be issued the same day. Some card companies may allow you to make online purchases until you receive your actual card. This may be helpful for some.

Depending on the financial emergency, instant approval may still not be immediate enough to get you out of a bind. In cases like these, you may need an alternative make up the difference. That is while you wait for your card to arrive.

Before applying, we recommend evaluating your current credit score. This will give you a realistic assessment of whether you’re likely to qualify when you apply. For instant approval credit cards, this is an important consideration if you know your credit is poor.

This matters because every time you submit a credit card application, the credit card company performs a hard inquiry. Creditors evaluate your credit report to determine whether you’re a qualifying candidate.

If you submit multiple applications, you will probably end up with multiple hard inquiries on your credit report. Each of these inquiries will cost your credit score points. And they can stay on your credit report for up to two years.

If your credit is already in poor shape, a hard credit inquiry can damage it even further. This will make it even more challenging for you to be approved.

Once upon a time, travelers’ checks were considered the mainstay for making purchases while traveling abroad. Nowadays, airline credit cards have eclipsed them in popularity.

Not only are they safer than traveling with cash on your person, they can be used to make most purchases. This could spare you the hassle of having to convert your cash to local currency when traveling globally.

Did you know the best airline credit card can enable you to pay for airfare exclusively in frequent flier miles? If you travel often, a travel credit card can make it possible for you to never pay airfare again.

You can also take advantage of the other perks associated with airlines credit cards. These include discounted or free lodging at participating hotels and discounted or free rental cars.

Based on this description, you may think a travel credit card is the same as a cash back credit card. Many of them do offer cash back, but there are a few important differences to be aware.

The majority of airline credit cards operate according to a points-based system. They award you one point (equivalent to one mile) for every dollar you spend. Certain purchases can earn you bonus points, and extra points may be available if you are enrolled in a loyalty program.

These points are redeemable for airline miles. But some credit card companies will offer alternative rewards. These include discounts on cruises, hotel rooms, car rentals, or airline seat upgrades.

The best airlines credit card will commonly offer all of the above.

While most travel credit card rewards programs adhere to the one-point-per-dollar rule, some will give you the opportunity to collect additional points for certain purchases, such as a meal from a specific location, or gas purchased during your trip.

The best airline credit card will offer these perks and more.

Additionally, many offer bonuses if you exceed their minimum spending requirements within the first few months of opening your account, or give you additional bonus points or statement credit if you refer a friend.

Loyalty programs afford cardholders another way to collect bonus points. If you have a loyalty branded travel credit card and you dine at a participating restaurant or make a purchase from a partner store, you can increase your points.

Many of these cards are also linked to “shopping portals,” allowing you to earn additional points when you make online purchases through certain websites.

How those points can be redeemed varies from one credit card company to the next. Many companies will simply transfer your points to whichever partner program you select, converting your points into airline miles, hotel room accommodations, or something else.

It’s important to note that these conversions aren’t typically one-to-one. In other words, if you redeem 20,000 points, that may equate to only 16,000 airline miles.

It’s a good idea to familiarize yourself with a airline credit card company’s policy for redemption before you apply to ensure you’re getting a deal consistent with your preferences. The more informed you are, the easier it will be for you to select the best travel credit card.

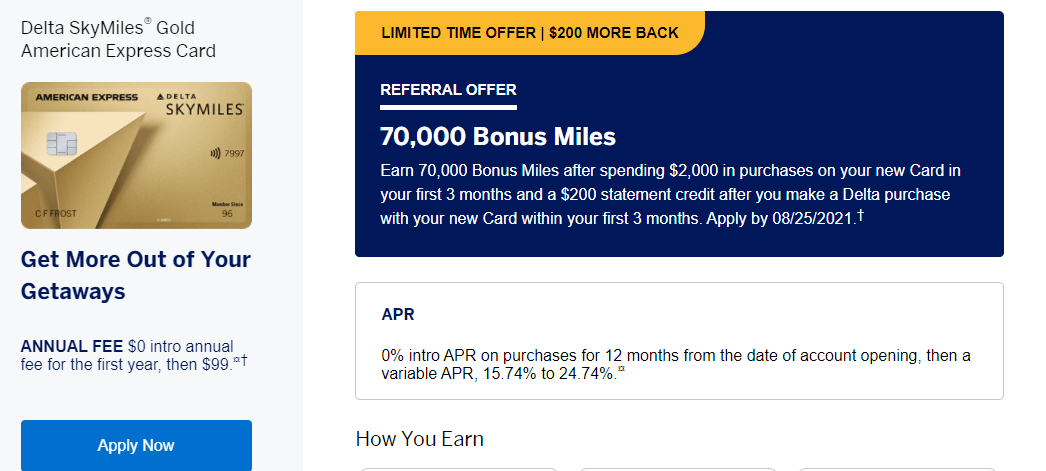

No list of the best credit cards would be complete without talking about the Delta SkyMiles American Express Credit Card (AMEX), one of the best cash back credit cards available today – and also one of the most exclusive.

For years, the name American Express has been associated with a certain level of prestige, and for good reason. Only high-income applicants with good credit scores qualify, and being a cardholder generally comes with perks. If your application is approved, you can soon be enjoying a variety of incredible perks including cash back, travel miles, and more.

What credit score do you need for the Delta SkyMiles American Express credit card?

Unlike your average student credit card or secured credit card, the Delta credit card can be challenging to qualify for. Approved applicants generally have a credit score of 680 or higher from all three credit bureaus, as well as a higher income than other creditors require.

This is because American Express offers a number of perks that don’t come with your average credit card. It’s widely recognized as being one of the best credit cards available around the world, and with that reputation comes a degree of exclusivity.

There are several different tiers of AMEX card, and the higher up the ladder you go the more challenging they become to obtain. However, the returns they yield also become more profitable, and if you manage your spending wisely you can reach a point where your travel-related expenses practically pay for themselves thanks to the rewards you get back.

First, let’s take a look at Delta SkyMiles credit cards so you can determine which is the best…

This Delta credit card is a rewards card that comes without an annual fee. It’s a good option when you already have a good to great credit score. It lets you save on Delta flights and at restaurants.

This Delta credit card is a rewards card that comes without an annual fee. It’s a good option when you already have a good to great credit score. It lets you save on Delta flights and at restaurants.

This Delta credit card is a rewards card that comes without an annual fee. It’s a good option when you already have a good to great credit score. It lets you save on Delta flights and at restaurants.

This Delta credit card is a rewards card that comes without an annual fee. It’s a good option when you already have a good to great credit score. It lets you save on Delta flights and at restaurants.

After looking at the options for credit cards, you should now be able to distinguish the benefits of each to choose which is best for you.

Because everyone’s situation is different, you must check the features against your situation to find the right card for you.

For instance, if you are completely against paying an annual fee, then the Blue card is your top choice.

While if you want to get the most benefit out of your card, then you may lean towards the Platinum or Reserve cards. Currently, these are the only two that offer Delta SkyClub access.

The majority of people would probably choose the Gold card as it offers a balance of features without being too costly.

Best for $0 annual fee: Delta SkyMiles Blue American Express Card

10,000 (after spending $500)

15.74% – 24.74% (Variable)

$0

Best for free checked bags (on Delta flights): Delta SkyMiles Gold American Express Card

60000 miles (after spending $2k)

15.74% – 24.74% (Variable)

$0 First Year ($99 subsequent years)

Best for Delta Miles: Delta SkyMiles Platinum American Express Card

75000 miles and 10000 MQMs (after spending $3k)

15.74% – 24.74% (Variable)

$250

Best for lounge access: Delta SkyMiles Reserve American Express Card

50000 miles and 10000 MQMs (after spending $3k)

15.74% – 24.74% (Variable)

$550

Next, let’s take a look at other American Express credit cards…

This is the most common American Express card and the easiest to obtain. Qualifying applicants have a credit score in the mid- to high 600s and a high income. With the Green Card, you have the choice of paying your minimum balance, full balance, or anything in between, and you can have a balance with interest on certain charges of $100 or more. Plus, you’ll get membership reward points that can be applied to future travel, hotel bookings, cruises and more. Look at the latest offers and secure your card now!

This “perks” card gives you three to four times the membership rewards points as the Green Card and includes travel, dining, and shopping discounts through participating retailers. Your credit score should be between 720 and 750 in order to qualify. You can get up to $120 in dining credit each year and $120 Uber cash annually. Best of all, there are no foreign transactions fees, making this card ideal for use while abroad. Look at the latest offers and secure your card now!

Though the typical qualifying applicant has a credit score of around 730, qualification at this level is not based on your credit score but your income, making it considerably more exclusive than an ordinary American Express card. With this card you can receive up to 60,000 bonus points when you spend $5000 within the first three months of opening your account, enjoy airline fee credit, Uber credit, hotel upgrades, and entry to any American Express airport lounge, among other perks. Look at the latest offers and secure your card now!

This is one of the best cash back credit cards for high-income applicants, but it’s also one of the most exclusive. You must have a very high income and a very high credit score in order to qualify, and even if you meet those qualifications you may still be granted a credit limit of only a couple thousand. The upside is that if you qualify, you’ll receive cash back after your first $1000 in purchases in the form of a credit on your account. Look at the latest offers and secure your card now!

Also known as the “Black Card,” this American Express card has alternated between being open-signature and invitation-only over the years and is arguably one of the best cash back credit cards there is, if not the best. This card offers 1.5% cash back on every purchase excluding airfare redemption, which yield 2% back. To qualify, you must be able to pay a $7500 initiation fee as well as an annual $2500 fee for each card you have. To keep the card, you must meet an annual $250,000 spending minimum. Look at the latest offers and secure your card now!

These cards all come with an impressive assortment of perks including cash back, travel rewards, hotel rewards, restaurant rewards, and more. In the case of the American Express Centurion Card, cardholders can also enjoy the Centurion Lounge found in many airports.

Though it’s challenging to qualify, American Express makes it worth the investment for those deemed creditworthy. These are just some of the reasons why American Express has long enjoyed a global reputation for offering the best credit cards.

Though the restrictions are tight, there are a few ways you can increase your chances of approval for an American Express credit card:

You may face a large hurdle with approval on your credit card application.

Of course, I believe in you.

And once you’ve overcome that obstacle, you’ll discover the incredible awards American Express has to offer. Loyal consumers get cash back bonuses, travel rewards, referral bonuses, and more.

The specific perks you can expect to receive vary depending on which Delta American Express credit card you have. Even at the most basic tier you can enjoy exceptional payment flexibility and numerous rewards.

Once your Delta SkyMiles credit card application is approved and your creditor has issued your card, you’ll want to strategize your usage to ensure it yields the maximal possible payoff. Here are some tips for making the most of the benefits your new credit account.

At the end of the day, the most rewarding thing you can do is use your credit card moderately. Then pay off the balance faithfully each month.

This will ensure that your credit score remains intact or increases. And your creditworthiness never declines. So you can keep enjoying the many wonderful rewards the Delta SkyMiles credit card has to offer

Kartra and Leadpages both help you grow your business online fast. But they serve different purposes, so the choice really depends on you.Kartra is an

A membership site gives content only to people who sign up first. It’s great for courses, training, digital products, or private communities. You control who

Kartra is an all-in-one platform made for online businesses. It helps you build, launch, and grow your business from one place. You don’t need ten

Copyright 2021 Dwayne Graves Online | All Rights Reserved |