Kartra vs. Leadpages: Which is Better for Your Lead Generation?

Kartra and Leadpages both help you grow your business online fast. But they serve different purposes, so the choice really depends on you. Kartra is

An unsecured business line of credit gives you flexible access to funds. You don’t need to put up assets like property or equipment. It’s different from a loan because you only pay for what you use.

You get approved for a set amount, like $10,000 or $50,000. Use it when needed: for inventory, payroll, or unexpected business costs. It’s helpful for small businesses with no major collateral.

Banks or online lenders check your credit and business income. If approved, you can draw money anytime, like a credit card. Repay it fast or slowly, depending on what works for you.

Affiliate Disclaimer: I earn commission (get paid) if you click on the links and purchase a product below. My earnings do not impact the price you pay.

It helps you handle cash flow issues or grow your business. You can keep operations smooth without long loan applications every time.

In this guide, you’ll learn how to qualify and apply fast. Let’s walk through the full process step by step!

An unsecured business line of credit works like a credit card. You get approved for a set amount; let’s say $20,000 or more. You don’t pay interest unless you actually use the funds.

Use it anytime for business expenses like supplies or marketing. Pay it back, and the credit becomes available again. There’s no fixed monthly payment like traditional loans require.

You only pay interest on what you borrow, not the full limit. It’s flexible and great for short-term needs or sudden expenses.

Perfect for handling slow months or taking quick growth opportunities. Some lenders offer online access so you can withdraw instantly.

Many types of businesses can apply for an unsecured credit line. Small business owners often use it for everyday business needs. Freelancers may use it for tools, software, or project costs.

Startups apply to handle early expenses or short-term cash flow. Even grocery shop owners can qualify if they meet the rules.

Lenders usually check your monthly income and business revenue. They also want to know how long your business has run. Most lenders prefer at least 6 to 12 months in business.

Your personal or business credit score will also be reviewed. A higher score increases the chances of getting approved quickly.

Some lenders accept lower scores but charge higher interest rates. A solid business plan also helps in the application process. The stronger your business looks, the better your offer will be.

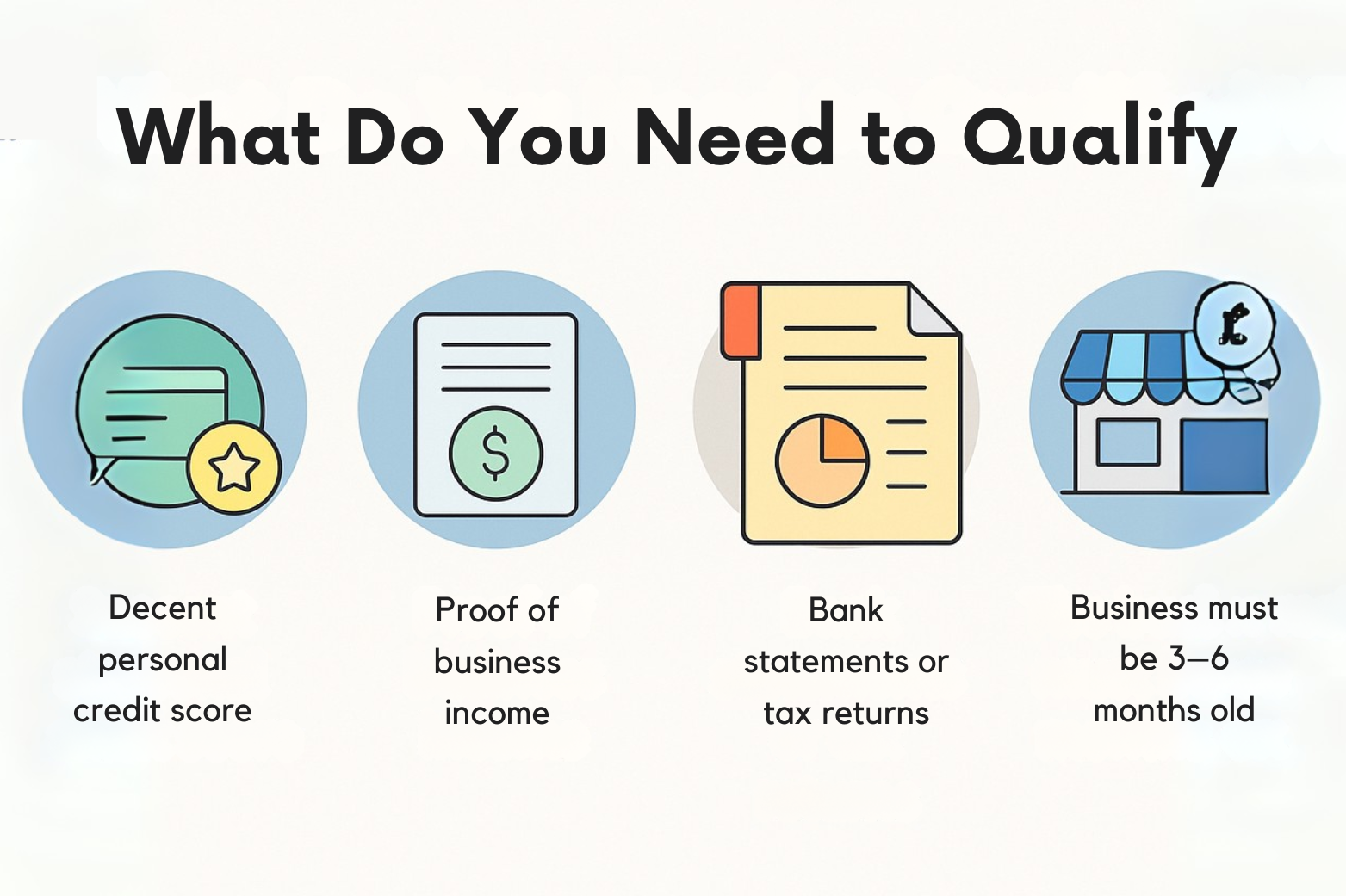

To qualify for an unsecured business line of credit, you need a few things. Lenders want to know your business is stable and trustworthy.

They also check your credit and income. These are the common requirements most lenders ask for:

Some lenders also ask for a business plan or revenue projections. This helps them feel confident you can repay the borrowed funds.

If your business is new, showing strong cash flow can still help. Even if your credit is not perfect, you may still qualify. Just expect a lower limit or higher interest.

The better your documents and credit, the better the terms. Always be honest and double-check all your documents before applying.

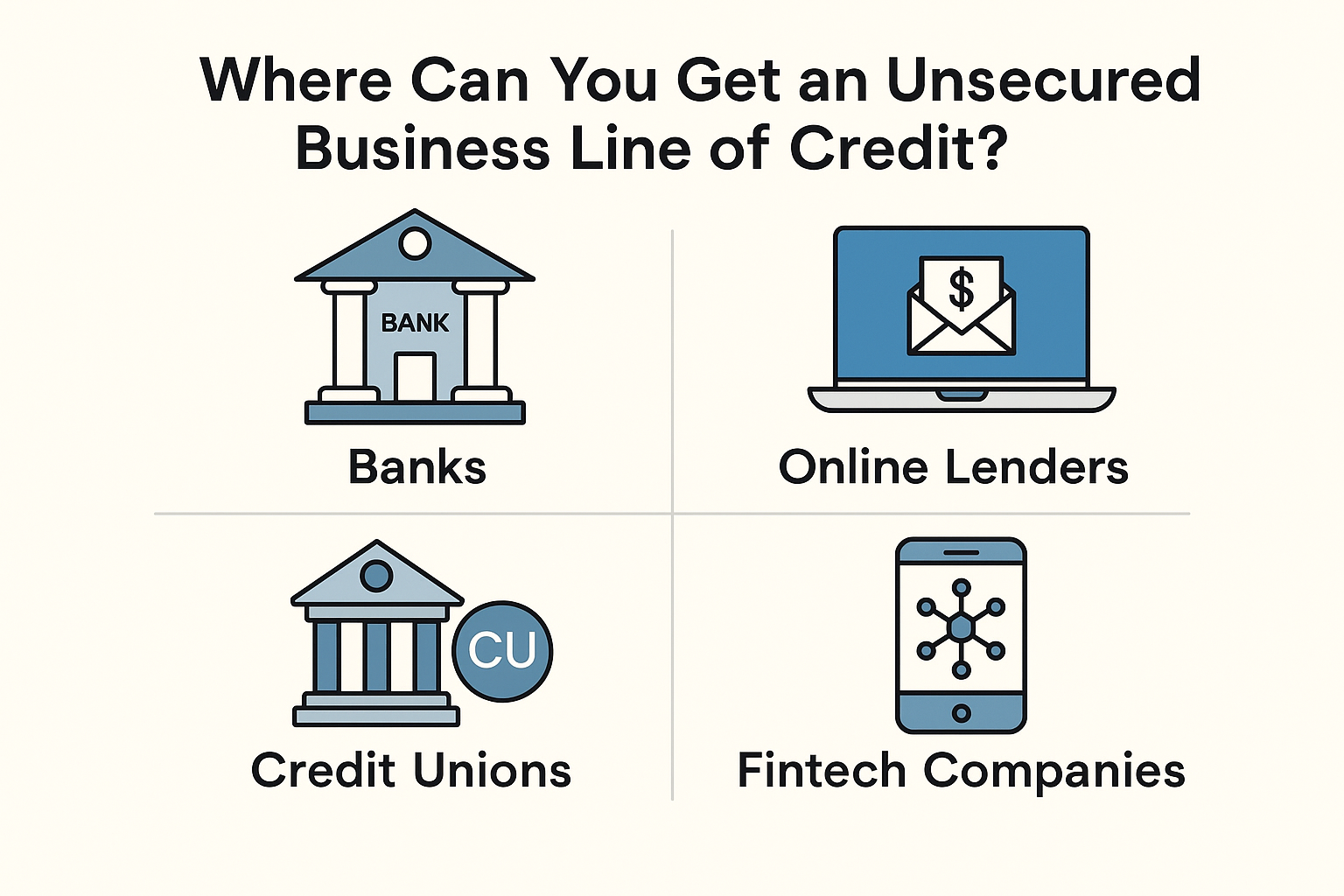

There are multiple ways to get an unsecured business line of credit. Here are some common places from which you can get it:

Banks offer business lines of credit with trusted service and terms. They usually need higher credit scores and longer business history.

Online lenders work fast and ask for fewer documents. Great for startups or small businesses that need quick access.

Credit unions often offer lower rates and personalized customer service. You may need to become a member first to apply.

Fintechs offer flexible credit lines using modern apps and fast systems. They often check alternative data beyond just credit scores.

Compare fees, terms, and interest rates before applying anywhere. Check the repayment schedule and make sure you can handle it.

Also, read reviews and see what others say about their support. Start with the one that fits your business size and credit profile. Each option suits different stages of your business journey.

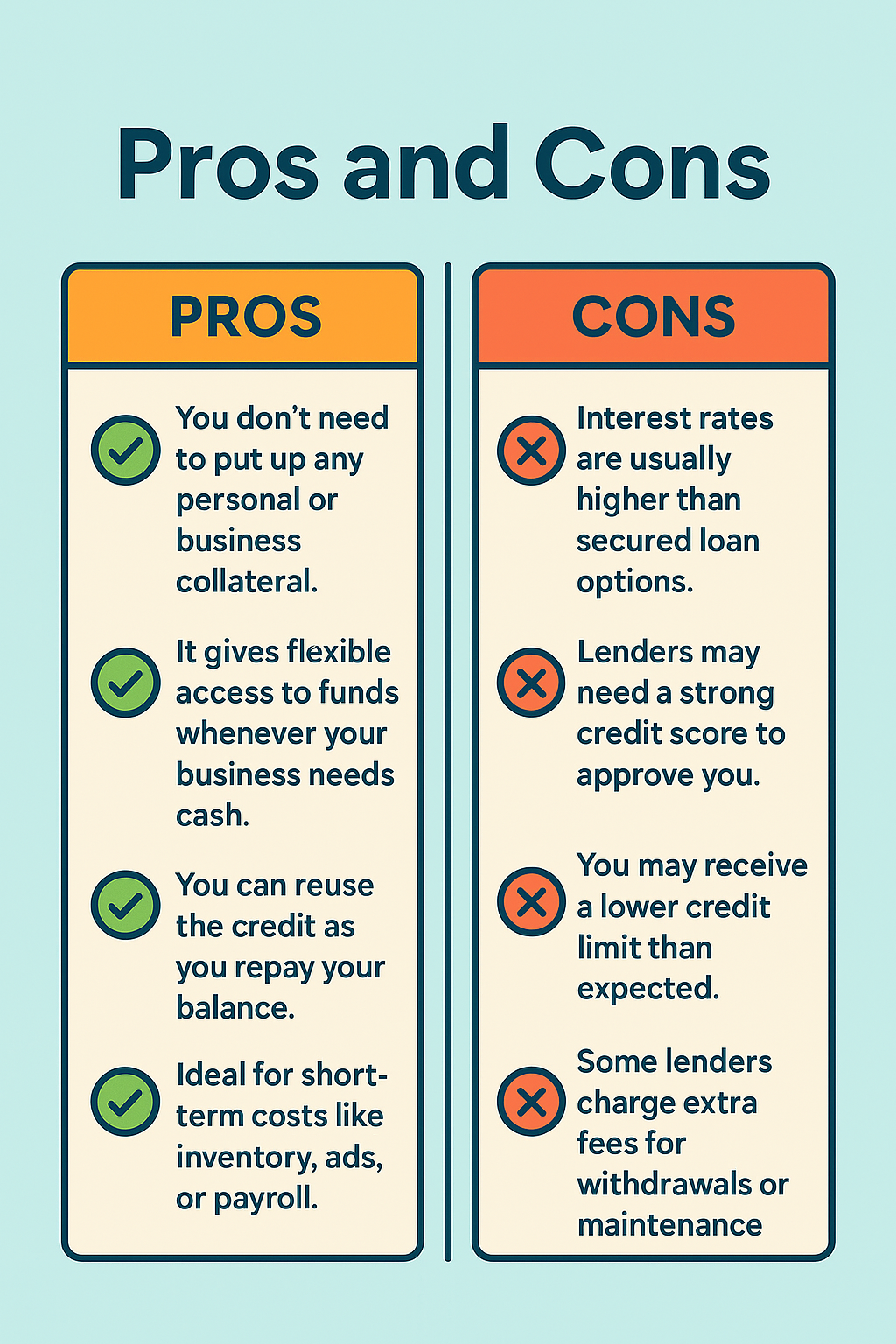

An unsecured business line of credit is helpful, but not perfect. Let’s break down the main pros and cons to consider:

So, weigh the good and bad before applying for credit. If your business has strong cash flow, this may be worth it. Just be sure you can handle the repayment terms responsibly.

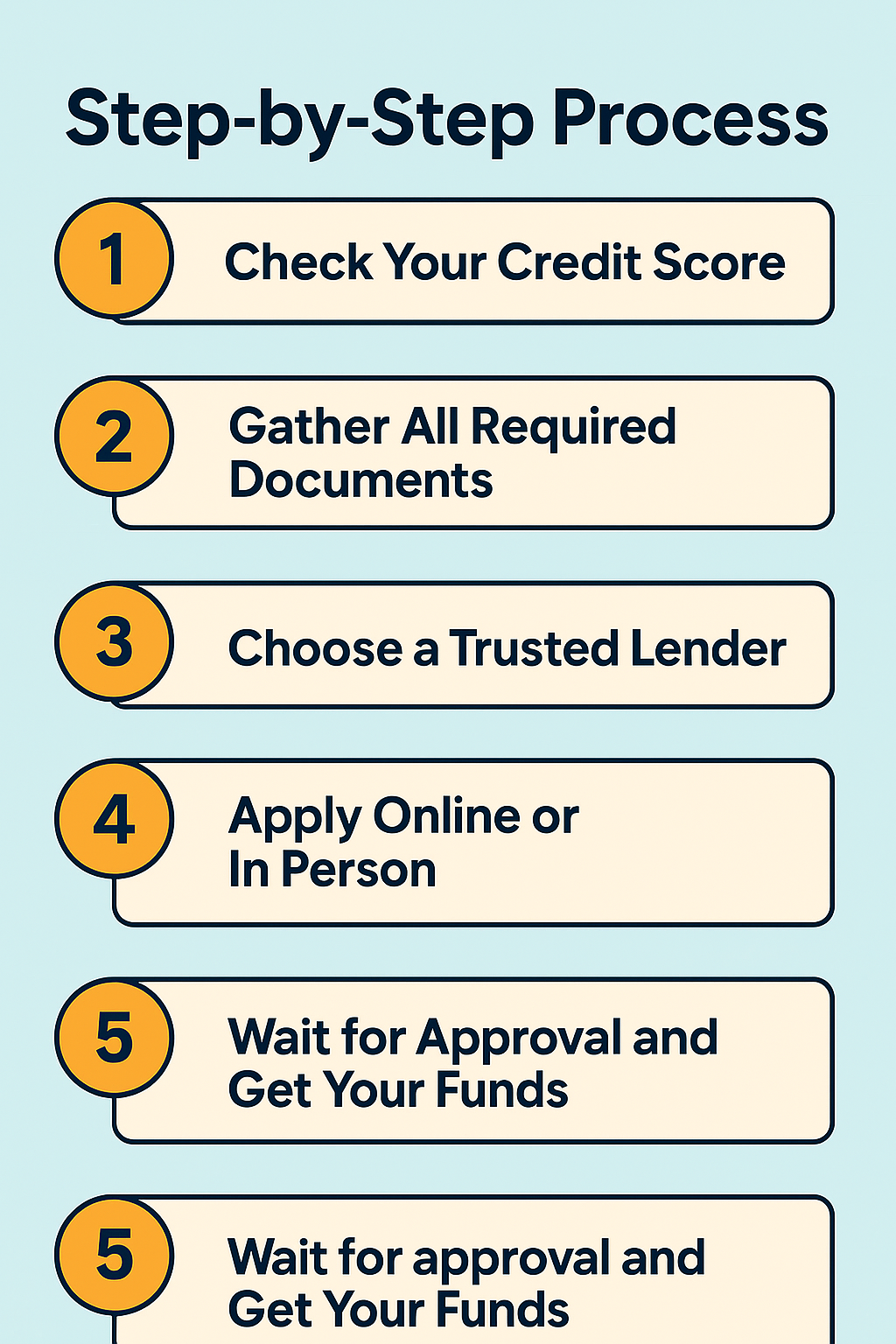

Getting an unsecured business line of credit is simple and clear. Follow these basic steps to move forward with your application fast.

Lenders want to see if you’re trustworthy and can repay. A score of 600 or higher is usually a good start.

Here’s a recap of all key documents you need:

You can go to banks, credit unions, or online lenders. Compare interest rates, fees, and repayment options before choosing.

Fill out the form with accurate personal and business information. Some lenders may call or email for extra details.

Approval can take hours or a few days, depending on the lender. Once approved, you’ll access the funds in your account quickly.

An unsecured business line of credit is flexible and easy to use. It helps cover short-term costs without using your assets as backup.

You can use the funds anytime and repay only what you use. It’s perfect for small businesses, startups, and even freelancers.

You don’t need to offer any collateral to get approved. Online lenders and banks both offer this funding option today.

Make sure your credit score and documents are ready before applying. If used wisely, it can help your business grow and succeed.

Kartra and Leadpages both help you grow your business online fast. But they serve different purposes, so the choice really depends on you. Kartra is

A membership site gives content only to people who sign up first. It’s great for courses, training, digital products, or private communities. You control who

Kartra is an all-in-one platform made for online businesses. It helps you build, launch, and grow your business from one place. You don’t need ten

Copyright 2021 Dwayne Graves Online | All Rights Reserved |