Starting an online business feels exciting, but money management can quickly become confusing. Many beginners think they’re doing well because profit looks good on paper. But then they check their bank account and wonder, “Where did the money go?”

I remember one specific month in my early journey. My sales looked great. My reports showed profit. Yet my bank balance looked empty. That’s when I learned a lesson I never forgot: profit is not cash and confusing the two can break your business faster than any competitor.

Download Your Free e-Book

5 Simple Ways to Create Website & Landing Pages

Affiliate Disclaimer: I earn commission (get paid) if you click on the links and purchase a product below. My earnings do not impact the price you pay.

Most people start online with passion but no financial awareness. They believe income will take care of everything. They think profits mean they’re safe. But without cash flow awareness, even a profitable business can collapse. Bills come due. Subscriptions renew. Clients pay late.

And suddenly, the numbers don’t add up. You don’t need to be an accountant. You only need simple clarity. Taking control of cash flow means reducing stress, avoiding financial surprises, and building a business that survives long enough to succeed.

Throughout this guide, you’ll see real examples, simple frameworks, and beginner-friendly steps. I’ll highlight financial health, positive cash flow, and avoid surprises whenever they matter most. You’ll also see illustrative examples so nothing feels abstract or complicated.

By the end of this guide, you’ll understand your money better, manage it smarter, and avoid the painful mistakes most beginners make.

Let’s start making cash flow simple, practical, and unbelievably clear!

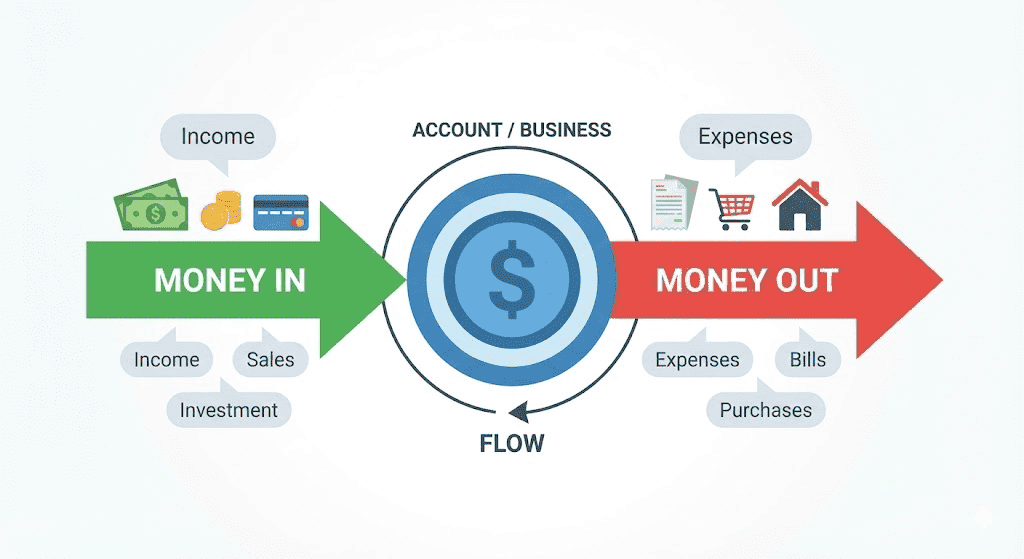

Understanding the Basics of Cash Flow

Before we jump into strategies, you need to understand what cash flow actually means. Not the complicated definition; the real-world one.

Cash flow is the movement of money in and out of your business.

That’s it.

But this simple idea becomes powerful once you break it down:

Inflow

Money that enters your business.

Examples: sales revenue, client payments, affiliate earnings.

Outflow

Money that leaves your business.

Examples: paying subscriptions, buying tools, hiring freelancers.

Net Cash Flow

The difference between what comes in and what goes out.

If inflow > outflow = positive cash flow.

If outflow > inflow = negative cash flow.

Know these basic terms to avoid the trap of thinking profit equals safety. Most beginners get hit by a painful surprise: they celebrate a “profitable month,” then realize clients haven’t paid yet. They have bills due, software renewals popping up, and not enough cash to cover them.

A short story

A friend launched her first freelance service. She closed $3,000 worth of projects in her first month. On paper, she felt rich. But two clients paid late. Her subscriptions have been renewed. Her marketing tool is charged yearly. Suddenly, she had $126 left in her bank.

Profit lied.

Cash flow told the truth.

Takeaway

Always track cash flow separately from profit. Profit tells you the score. Cash flow tells you if you can keep playing.

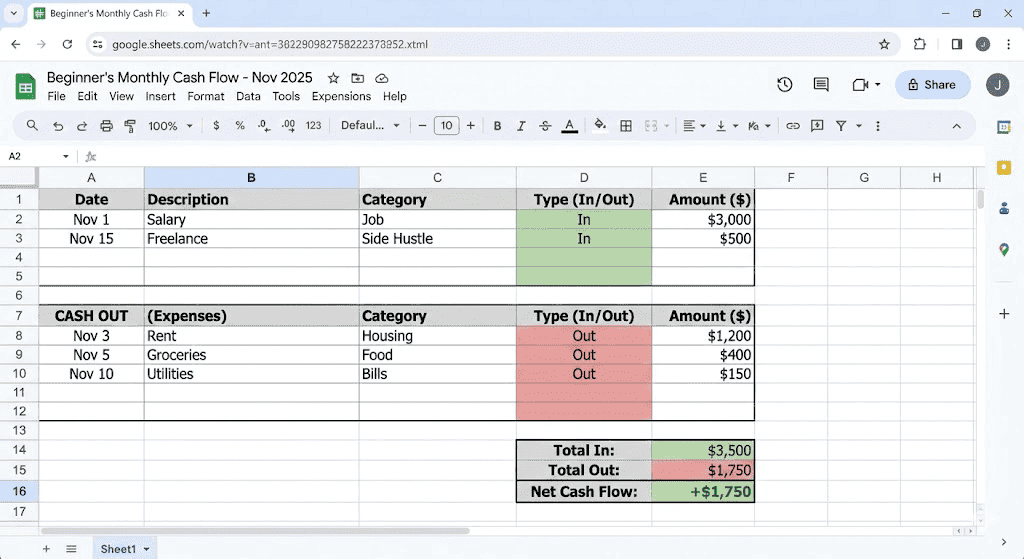

How to Track Cash Flow Without Overcomplicating It

Most beginners avoid cash flow tracking because they think it requires accounting software or financial expertise. Not true.

You can track cash flow with the three simplest tools on earth:

- A Google Sheet

- A basic spreadsheet

- A free budgeting app

The secret isn’t fancy tools; it’s all about consistency.

Why track weekly, not monthly?

Money moves fast online. Your expenses renew suddenly. Clients delay payments. Ad costs change overnight. Waiting until the end of the month is how people overspend without noticing.

Your simple tracking list

Write these in your sheet or app:

- Sales / client payments

- Affiliate earnings

- Subscriptions

- Marketing spend

- Tools and software

- Freelancers

- One-time expenses

This simple list gives you a clear picture of what’s happening day-to-day.

A beginner’s story

A new creator tracked expenses only at the end of each month. When he finally checked, he realized he had 22 small tools, draining $247 monthly. Once he reviewed his cash flow weekly, he cut 14 tools and saved his business.

Takeaway

Daily or weekly tracking avoids surprises and protects your business from silent leaks.

Prioritizing Expenses to Maintain Positive Cash Flow

Not every expense deserves your money. Beginners often spend emotionally, not logically. They buy software they don’t need. They subscribe to tools they barely use. They upgrade too early. Then they wonder where their cash went.

The solution? Separate expenses into two clear groups:

Essential Expenses

These directly support the business.

Examples: paying suppliers, software you use daily, marketing.

Non-Essential Expenses

Nice to have, but not required.

Examples: fancy design tools, advanced paid features, aesthetic upgrades.

This helps you practice financial control, budget prioritization, and healthy cash flow.

A small story

A beginner kept paying for eight content tools and three analytics platforms. His cash flow was always negative. Once he prioritized essentials, he kept only three tools and paid suppliers and marketing first. The late payment issues stopped. Cash flow stabilized.

Takeaway

Positive cash flow comes from protecting essentials and delaying non-essentials.

Handling Late Payments and Unreliable Cash Inflows

Client delays happen. Affiliate payments also may take weeks. Platforms hold payouts.

Refunds cut into earnings. If you depend on perfect payment timing, you’ll struggle constantly.

Smart strategies to stabilize inflow

- Require partial upfront payments

- Set clear payment terms

- Send polite reminders

- Offer early-pay discounts

- Use simple invoicing tools

Example

Request 50% upfront for freelance work. Suddenly, your income becomes much more predictable.

A short story

A beginner freelancer always struggled because clients paid whenever they felt like it. When she switched to 50% upfront, 50% on delivery, her income became stable. She finally breathed between projects.

Takeaway

Secure payments protect cash flow. Never rely on perfect client timing.

Creating a Cash Flow Forecast for Peace of Mind

Forecasting sounds complicated, but it’s actually simple: You’re predicting future inflow and outflow so you’re never surprised.

Why forecasting matters

- You know if next month will be tight

- You prevent overspending

- You avoid surprise bills

- You plan marketing or ad spend safely

Examples

Forecast next month’s income based on current clients.

Forecast upcoming bills like domain renewals, subscriptions, or ad spend.

A story

A small business owner forecasted her expenses for the next 60 days. She noticed she would fall $400 short because of two annual renewals. She adjusted her spending early and avoided running out of cash.

Takeaway

Forecasting gives you calm, clarity, control, and zero surprises.

Tips for Maintaining Healthy Cash Flow Consistently

Cash flow gets easier once you build consistent habits. Here are the most beginner-friendly ones:

1. Keep a buffer fund

Maintain at least one month of expenses in reserve.

2. Track weekly

Consistency beats complexity.

3. Automate essential payments

No late fees. No disruptions.

4. Review subscriptions monthly

Cancel anything underused.

5. Predict slow seasons

Plan ahead, not during emergencies.

Pro Tip Box: 5 Habits for Strong Cash Flow

- Update your cash flow sheet every Friday

- Keep 10 to 20% of income untouched as a buffer

- Increase essential spending only after revenue increases

- Set payment reminders for clients

- Review your financial forecast every two weeks

Takeaway

Healthy cash flow comes from simple habits repeated consistently.

Conclusion

Cash flow isn’t just a financial term. It’s the heartbeat of your online business. When it’s strong, your business feels stable. When it’s weak, everything feels stressful.

Let’s recap the essentials:

- Understand how money flows in and out

- Track cash flow weekly

- Prioritize essential expenses

- Handle late payments with a strategy

- Forecast the upcoming months

- Build healthy financial habits

You don’t need to be perfect. You don’t need fancy tools. You just need clarity, consistency, and confidence.

You’re building something important. You’re learning skills most people avoid. You’re taking control of your future with every small step.

Remember these words: start tracking today, stay disciplined, control your finances; not the other way around.

You have everything you need to manage cash flow confidently. Start now, even if it’s just one small step. Your business will thank you later.